BEIJING, Beijing, June 8 (Shang Qi) This year marks the 40th anniversary of the resumption of the college entrance examination system in China. Since 1977, the college entrance examination has influenced and changed the fate of several generations of China people. The gross enrollment rate of higher education has exceeded 40% from less than 2% at first, and is rapidly approaching the 50% popularization index line. Behind the data, how has the college entrance examination influenced and changed China in the past 40 years? 40 years later, what expectations has the college entrance examination been given by this country?

The picture shows that in December, 1977, the candidates of the Beijing College Entrance Examination Center communicated with each other. Weng Naiqiang Photo source: vision china

the resumption of college entrance examination

— — China’s concept of talents is changing.

On October 12, 1977, the State Council approved the Opinions on the Enrollment of Colleges and Universities in 1977 formulated by the Ministry of Education, which stipulated the new enrollment policy of colleges and universities, namely, abolishing the recommendation system, resuming the cultural examination, and selecting the best students.

This year, the slogan of "respecting knowledge and talents" took root in China. Li Muzhou, director of the Institute of Higher Education of Hubei University School of Education, has studied the examination system in China for many years. In an interview with a reporter from Zhongxin. com (WeChat WeChat official account: cns2012), he said that at the national level, the resumption of the college entrance examination 40 years ago is to show that the country attaches importance to talents and reconstructs the concept of talents.

He explained, "the resumption of the college entrance examination has confirmed the basic role of cultural knowledge and intellectual factors in the selection of talents in colleges and universities. This is a major change in the concept of national talents, and it can also be said that it is the correct return of the concept of national talents."

Education in China experienced a "warm winter" in 1977. According to statistics, at the end of that year, about 5.7 million young people "returned" to the college entrance examination, and colleges and universities selected 273,000 students, which greatly improved the quality of freshmen.

Over the past 40 years, college students selected through the college entrance examination have gone to various fields in China in batches. They witnessed and participated in the whole process of reform and opening up, and gradually became the backbone to promote the development of this country.

Recently, Liu Haifeng, member of the National Education Advisory Committee and director of the Examination Research Center of Xiamen University, wrote that since the resumption of the college entrance examination for 40 years, millions of qualified students have been selected for colleges and universities through fair competition in the college entrance examination, and many of them have become the backbone of all walks of life through training. China’s rapid economic development in recent years is inseparable from the recovery and continuous reform of the college entrance examination system.

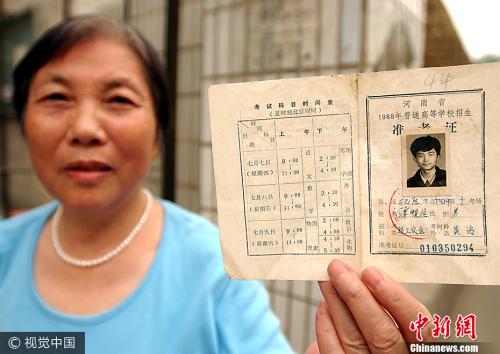

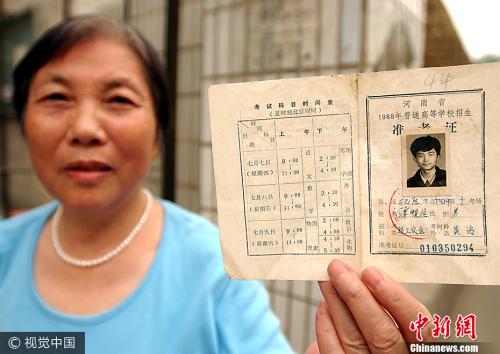

The picture shows a collector in Zhengzhou showing his collection of a 1988 college entrance examination admission ticket. Image source: vision china

40 years of practice

— — From elite education to mass education

"The college entrance examination has different meanings for people of different ages." Li Muzhou told Zhongxin.com that before the reform and opening up, the college entrance examination was largely about selecting national cadres. After the resumption of the college entrance examination, with the reform and opening up, the employment of college graduates gradually shifted from planned distribution to market competition, and more and more college graduates began to choose their own jobs.

As experts have said, in the past 40 years, with the changes in the country’s economic and social environment, the college entrance examination itself has also undergone changes. In 1999, the Ministry of Education issued the Opinions on Further Deepening the Reform of the Entrance Examination System in Colleges and Universities, and announced the national college entrance examination reform plan, which opened the prelude to the college entrance examination reform in this period. Since then, self-enrollment, self-proposition by province, and parallel volunteer admission have been explored one after another, and the recruitment methods of colleges and universities in China are more diverse.

Also in 1999, higher education in China began to expand the enrollment scale, and the admission rate of college entrance examination also began to rise sharply. According to statistics, from 1998 to 2005, the number of applicants for college entrance examination in China increased by 11.58% annually, and the number of college entrance examinations increased by 23.75% annually. By 2015, the number of students enrolled in higher education in China has reached 37 million, ranking first in the world.

According to China Education Online’s 2017 Survey Report, under the background that the total enrollment of college entrance examination has remained stable, the enrollment ratio of college entrance examination in all parts of the country has continued to increase. Among them, the gross enrollment rate of higher education has crossed 40%, rapidly approaching the popularization index line of 50%.

Compared with the gross enrollment rate of 1.55% in 1978, some people think that higher education in China has gradually moved from "elite education" to "mass education".

Li Muzhou said that higher education will enter the stage of popularization in the future, and the improvement of the popularization rate is conducive to the overall improvement of national literacy. He believes that "the future lies not in whether you have attended a university, but in what university you have attended, and this influence may be even greater."

The picture shows that on July 7, 1999, on the first day of the national unified entrance examination for colleges and universities in China, the candidates who took the examination walked out of the examination room. China News Service reporter Liu Kegeng photo

Knowledge changes fate.

— — Social strata circulate in relative fairness.

From "elite education" to "mass education", behind the overall improvement of the popularization rate, the educational equity behind the college entrance examination has always attracted public attention.

Last year, Bian Yanjie, dean of the School of Humanities and Social Sciences of Xi ‘an Jiaotong University and sociologist, presided over a report entitled "Career Opportunities for Rural College Students". According to media reports, all the target samples of the survey came from the existing labor force in the city and were divided into six groups: the first three received higher education, namely, urban college students, rural college students and non-transfer college students; The last three have not yet received higher education, including the general urban labor force, rural-to-non labor force and migrant workers.

According to the report, for college students from rural areas to urban areas, they have the same opportunities to work in party and government organs and state-owned enterprises, and they also have the same opportunities to engage in elite occupations, with similar economic income levels, while the three types of non-college students mainly engage in non-elite occupations.

Li Muzhou told the reporter of Zhongxin.com that the urbanization process in China is very fast, but the rural population still accounts for the vast majority. Therefore, the college entrance examination provides them with an important way to change their destiny through higher education.

The "Implementation Opinions of the State Council on Deepening the Reform of the Examination Enrollment System" issued in September 2014 clearly stated that the number of rural students attending key universities should be increased, and the national special plan for targeted enrollment in rural poverty-stricken areas should continue to be implemented, and key universities should target targeted enrollment in poverty-stricken areas.

The opinion also made it clear that subordinate universities and provincial key universities should arrange a certain proportion of places to recruit outstanding rural students from remote, poor and ethnic minority areas. In 2017, the number of rural students entering key universities in poverty-stricken areas increased significantly, forming a long-term mechanism to ensure rural students to attend key universities.

The picture shows the end of the first exam of the 2017 college entrance examination. Outside a test center in Nanning, Guangxi, parents snapped the candidates like "walking the red carpet". Yu Jing photo

Changes and Invariance of College Entrance Examination in the Future

— — Do you still believe in "one exam will fix you for life"?

In recent years, whenever there is a college entrance examination, there will be doubts about the disadvantages of the college entrance examination in public opinion, such as "a thousand troops crossing the wooden bridge", "one exam will set you for life" and "the baton of the college entrance examination".

As for the current examination enrollment system in China, the above-mentioned "Implementation Opinions of the State Council on Deepening the Reform of the Examination Enrollment System" also points out that the examination enrollment system in China is generally in line with the national conditions, authoritative and fair, and is recognized by the society. However, there are also some problems that are strongly reflected by the society. The main reason is that the score theory affects the all-round development of students, and the students’ learning burden is too heavy. There are gaps in enrollment opportunities between regions and urban and rural areas, and the phenomenon of cheating extra points and illegal enrollment occurs from time to time.

Nowadays, the scale of high school graduates studying abroad in China is increasing. It is pointed out by some voices that the growing number of students studying abroad also reflects from one side that parents and students in China are "voting with their feet" in the face of the college entrance examination.

"This will force the reform of the domestic college entrance examination system." Li Muzhou said that the foreign enrollment system has its advantages, such as multiple examinations, rich and flexible subject design, and relatively strong autonomy of colleges and universities … … These are problems that have not been completely solved in China’s college entrance examination system.

In fact, the practice of the college entrance examination in the past 40 years has not remained unchanged. Qu Zhenyuan, president of China Higher Education Society, pointed out to the media that in recent years, all aspects of college entrance examination enrollment have been reformed, including examination subjects, examination contents, examination times, examination methods, scoring methods, proposition methods, voluntary reporting methods, admission system, college entrance examination time, and charging system, and almost no aspect has not been tried or touched.

The latest changes have appeared in this year’s college entrance examination. These days, high school graduates in Shanghai and Zhejiang are welcoming the first "new college entrance examination". The results of the college entrance examination are composed of three unified college entrance examination scores of Chinese, mathematics and foreign languages, and three students’ self-selected examination subjects. The foreign language test is changed from once a year to twice a year, and you can choose a better score to be included in the total score of the college entrance examination.

Chu Zhaohui, a researcher at China Academy of Educational Sciences, said in an interview with Zhongxin.com that the reform of the college entrance examination enrollment system will be in a period of fluctuation in the coming period, and the key to the reform of the college entrance examination is to implement more professional evaluation.

He said, "The current examination system can achieve good results through a lot of training, and the actual test results are relatively distorted. As a professional education evaluation, the influence of intensive training on the test results should be eliminated as much as possible."

Li Muzhou hopes that through the reform of system design, the situation of "one exam will be fixed for life" will be changed.

"For example, let students have multiple exams and even multiple admissions opportunities, and further strengthen the separation of recruitment. Colleges and universities should study their own school-running orientation, formulate examination plans that meet their freshmen’s characteristics, and gradually break the people’s inherent understanding of the college entrance examination." He said.

Obviously, 40 years later, the college entrance examination still carries the heavy expectations of this country. (End)